Introduction

Find out why NVIDIA, ASML, TSMC, Occidental Petroleum, and BYD are the best stocks to invest in for 2025 and their comparative analysis. Research possibilities of AI, energy, and EV sectors and compare valuations, industries’ trends, and growth potentials.

Technology driven global investments in the year 2025 will be a reflection of the changing trends in energy and the increasing focus on electric vehicles. There are growing opportunities in fields such as artificial intelligence (AI), semiconductors, oil and gas and electric vehicles (EVs) among others. This article focuses on five rather unique players — Nvidia Corp. (NASDAQ: NVDA), ASML Holding NV (NASDAQ: ASML), Taiwan Semiconductor Manufacturing Company Ltd. (NYSE: TSM), Occidental Petroleum Corp. (NYSE: OXY), and BYD Co. Ltd. (OTC: BYDDF) — explaining their main parameters and shares of the market and their potential for future growth.

5 Best stocks to invest in 2025: A comparative Analysis

These companies can provide significant opportunity for high returns in 2025 if the growth is fueled by the AI revolution, new energy types or EV dispersal.

Important Shareholder’s Metrics

The table below highlights key valuation ratios of the companies in question based on the trailing twelve-months (TTM):

Here’s the updated table reflecting the provided data: [1] [2] [3] [4]

| Company | PE Ratio | PB Ratio | EBITDA (in Billion USD) | Net Income to Common Stockholders (in Billion USD) |

| NVIDIA (NVDA) | 52.85 | 50.6 | 74.87 | 29.76 |

| ASML Holding (ASML) | 38.91 | 15.17 | 9.14 | 7.53 |

| TSMC (TSM) | 32.26 | 8.16 | 1,726.71 | 33.32 |

| Occidental Petroleum (OXY) | 13.05 | 1.63 | 14.01 | 0.718 |

| BYD (BYDDF) | 21.56 | 1.12 | 44.68 | 33.91 |

PE and PB Ratio Analysis: NVIDIA, ASML, and TSMC

NVIDIA: AI Giant

| Average PE Ratio | 49.9 |

| NVIDIA (NVDA) | 52.85 (above average) |

| Average PB Ratio | 19.33 |

| NVIDIA (NVDA) | 50.6 (well above average) |

NVIDIA (NVDA): Both its PE (52.85) and PB (50.6) ratios are significantly above the sector averages, indicating it is highly valued relative to earnings and book value. For detailed price prediction analysis for NVIDIA: NVIDIA Stock Analysis Post-Q3 FY25 Earnings.

ASML: AI Backbone

| Average PE Ratio | 49.9 |

| ASML Holding (ASML) | 38.91 (below average) |

| Average PB Ratio | 19.33 |

| ASML Holding (ASML) | 15.17 (below average) |

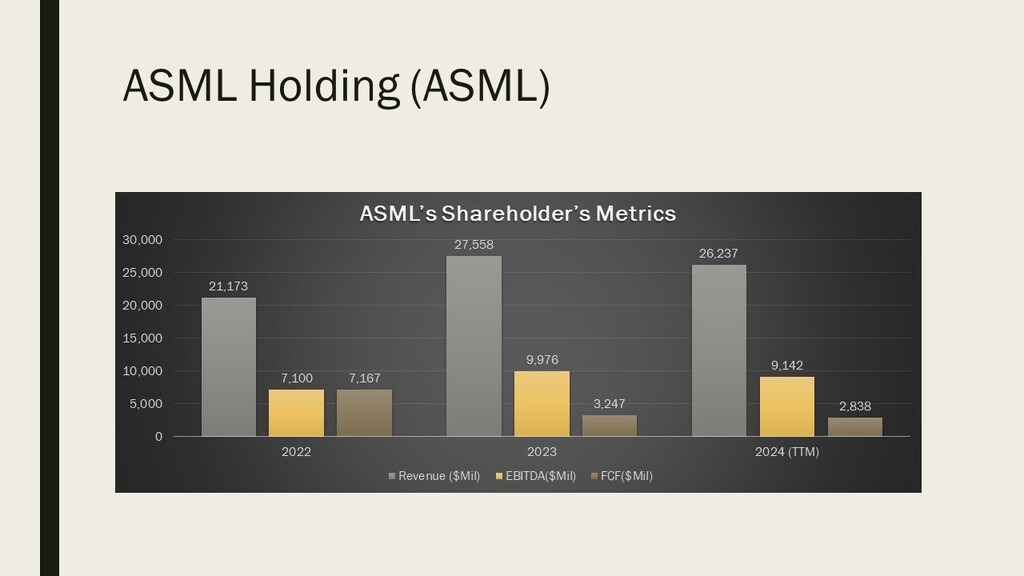

ASML (ASML): Its PE (38.91) is below average, while its PB (15.17) is slightly below average, suggesting a more conservative valuation. Learn about the fair price prediction for ASML: ASML Stock Forecast from 2025 to 2035.

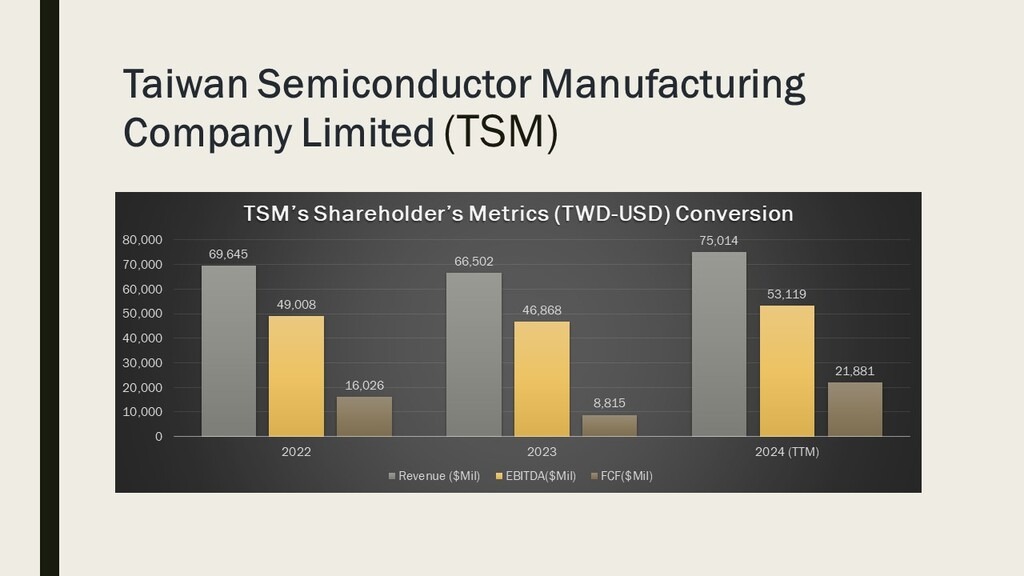

TSMC: Chip Giant

| Average PE Ratio | 49.9 |

| TSMC (TSM) | 32.26 (below average) |

| Average PB Ratio | 19.33 |

| TSMC (TSM) | 8.16 (well below average) |

TSMC (TSM): Both its PE (32.26) and PB (8.16) ratios are well below the sector averages, indicating it is relatively undervalued compared to its peers.

NVIDIA (NVDA) has a PE ratio of 49.9, making it slightly more expensive than its competitors. This suggests that investors may pay higher prices for the company’s stocks, potentially affecting its reputation and growth prospects. ASML and TSM may have lower other expenses than NVIDIA due to lower PE ratios than the average for the industrial sector. TSMC has been more cost-effective than ASML, with a PE ratio slightly below the industry average. Therefore, it is possible that ASML and TSM may have lower other expenses than NVIDIA.

NVIDIA (NVDA) currently has a PB ratio of 50.6, which is significantly higher than the industry average of 19.33. Furthermore, it demonstrates that stock is engaged at significantly higher levels in comparison to book value. This is most likely owing to the fact that NVIDIA has a very substantial market share, a powerful brand, and the possibility for additional technological progress. [5]. ASML (ASML) and TSMC (TSM) have PB ratios below the average, with ASML being slightly below and TSMC being much lower. According to the PB ratio, it is comparatively less expensive than ASML and NVIDIA, indicating that the market has a somewhat more cautious attitude toward TSMC stock. [6]

Hence, the lowest PE and PB scores may indicate that investors have overvalued the company, even though NVIDIA (NVDA) is among the top performers in the sector with plenty of room to grow. Given its more defensive and specialized positioning, we believe that ASML is likely to be valued a little more conservatively than NVIDIA, despite being somewhat less expensive in terms of PE and PB and still slightly higher than the sector average. Since TSMC’s TSM is the least pricey of the three, value investors may find it inexpensive in comparison to its competitors because its PE and PB ratios are below average. [7]

Which stocks will rise in 2025?

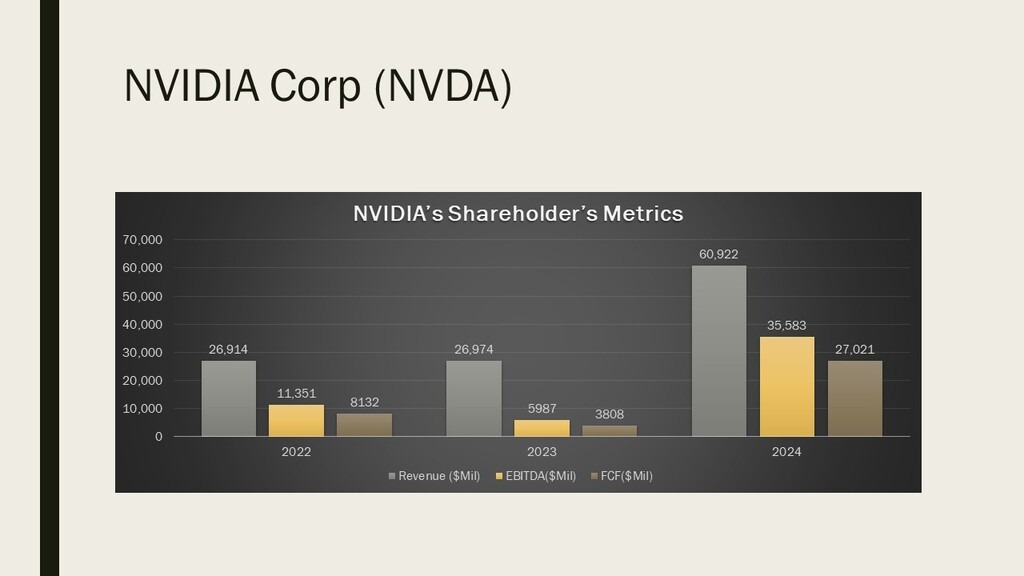

It is anticipated that NVIDIA Corp. (NVDA) will continue to do well in 2025 due to this revolutionary effect on the artificial intelligence market. As the creator, developer, and manufacturer of GPUs — the essential components of AI computing — NVIDIA is in a strong position to reap benefits from the growing use of AI. NVIDIA, which now holds the largest market share for AI hardware particularly for deep learning and data centers, is expected to maintain the momentum of AI as it grows faster.

Additionally, being the largest semiconductor manufacturer in the world, TSMC (TSM) will continue to play a significant role in the production of chips needed for AI applications including data processing and machine learning. Due to its scope, size and experience, TSMC is a vital player in the chip manufacturing industry, and as the AI business expands, so will its revenue. [8]

Similarly, ASML Holding (ASML), the leading manufacturer of advanced lithography systems around the world, is also expected to float. The company’s technology aids in the development of the most cutting-edge production processes for the most complex chips utilized in artificial intelligence systems. These three businesses are in a strong position to capitalize on the present trends in the artificial intelligence boom, and the moves in this significant industry will also boost their stock prices. [9].

Which AI stocks will boom in 2025?

Given their prominence in the AI sector, NVDA, TSM, and ASML are anticipated to continue to boom in 2025. Deep learning and data center solutions are developed by NVIDIA, a pioneer in GPUs that use artificial intelligence. While ASML has the necessary equipment to produce the majority of advanced semiconductors, TSMC, the world’s largest chipset manufacturer, will be essential in meeting the growing demand for AI chips. Collectively, these businesses establish the contemporary framework of the AI sector.

However, investors should exercise caution when investing in AI stocks, as their valuations have soared during the AI boom. Even while these opportunities seem to be somewhat far away, the high valuations that are currently in place can increase risk and induce price swings. The AI sector is both profitable and high-risk, so this is a great spot to remind investors to assess their risk tolerance levels. While those with a lower tolerance should research market volatility and adjust their behavior accordingly, higher risk takers will be more drawn to growth prospects.

Valuation Insights and Investment Opportunities

Due to their dominance in the ecosystem, significant companies like NVIDIA Corp, TSMC, and ASML Holding have seen their valuations rise to unprecedented heights owing to the hype around AI. NVIDIA, the market leader in GPUs for AI and machine learning, is trading at a premium due to the stock’s high risk profile and potential for rapid growth. [10].

Another pair of businesses seen as extremely significant are TSMC, a worldwide semiconductor foundry, and ASML, a producer of lithographic systems, as they are the primary suppliers of the machinery needed to produce chips for artificial intelligence applications.

These businesses do, however, present excellent growth prospects, but their lag in P/E leaves them open to swings. It goes without saying that investors must weigh potential market downturns against elements like future revenue growth. Long-term investors who want to share in the activity brought about by the AI revolution may find these stocks interesting, but they should always keep their risk management plans in mind. Increased diversification within the broader technology sector can also aid in balancing risks and possible rewards. [11]

Conclusion

AI is transforming businesses and sectors at a historic rate, which will lead to tremendous opportunity for companies like ASML Holding (ASML), TSMC (TSM), and NVIDIA Corp (NVDA). The trio of NVIDIA, Taiwan Semiconductor Manufacturing, and ASML are leading the way in AI technology, with NVIDIA delivering top-tier GPUs, Taiwan Semiconductor Manufacturing delivering efficient semiconductor manufacturing, and ASML delivering top-notch lithography technology.

These companies are expected to become more valuable by 2025, but investors should be cautious due to their high costs. These stocks offer businesses opportunities to grow and become a popular technology form. To create a risk-to-return ratio, buyers should assess their tolerance for risks and act accordingly. AI-related investments could yield high returns in the future. Any investor, whether they are risk-averse or growth-seeking, can benefit from this since it will help manage information about these ever-changing prospects.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.